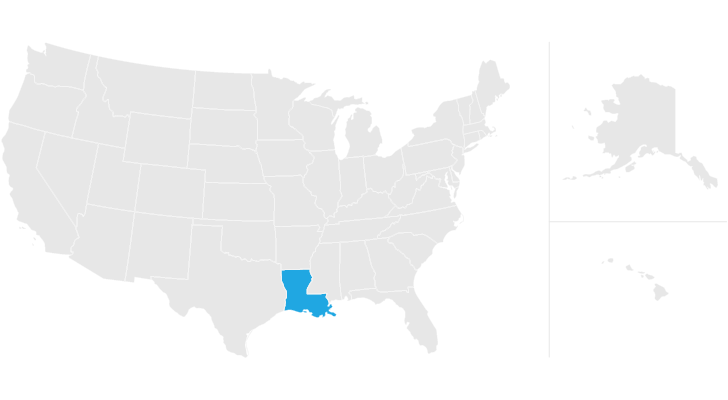

louisiana estate tax return

The federal estate tax exemption was 1170 million in 2021 and increased to 1206 in 2022. An estates tax ID number is called an employer identification.

Louisiana Succession Taxes Scott Vicknair Law

Estate Tax Return Fiduciary Income RS.

. Does Louisiana Have an Inheritance Tax or Estate Tax. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. State income tax changes for 2022 and beyond.

The gift tax return is due on April 15th following the year in which the gift is made. Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must. Louisiana law that made it possible that an estate transfer tax return be submitted if the decedents net estate was 60000 or more.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Estate Tax Return After 9 months from decedents death or 1st day after filing US.

The estate will then be given a federal tax credit for the amount of state estate taxes paid. The Louisiana Department of Revenue manages collection of the states individual income tax as well as other taxes like Louisiana sales tax consumer use tax gift tax and estate transfer taxes. Requirements for Filing Returns Inheritance taxAn inheritance tax return must be prepared and filed for each succession by or on behalf of all the heirs or legatees in every case where inher- itance tax is due or the value of the deceaseds estate is.

Louisiana State Tax Return - I had my taxes done and was E-filed 4 weeks ago. 31 rows Generally the estate tax return is due nine months after the date of death. Federal Estate Tax.

Louisiana estate tax return Monday March 21 2022 Edit A tax rate of 6 06 is assessed on the total distributive shares for nonresident partners included on the Louisiana Composite Return. For other forms in the Form 706 series and for Forms 8892 and 8855 see the. Louisiana income tax changes that went into effect on Jan.

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. More than 45 days. Though Louisiana wont be charging you any estate tax the federal government may.

I received my Federal return about 10 days later but still havent received my State. The exemption is portable for married couples. No Act 822 of the 2008 Regular Legislative Session.

1 have no impact on 2021 state income tax returns and payments due May 16 2022. Do You Need to File a Tax Return for the Estate. Does Louisiana impose an inheritance tax.

472431 - 472437 9 months after decedents death or prior to filing US. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. Just because Louisiana doesnt have an estate tax or inheritance tax doesnt mean youre in the clear as far as the IRS is concerned.

Non-resident LA state returns are available upon request. This means a couple can protect up to 2412 million when both spouses die for 2022 deaths. If you have income tax questions or need technical help while filing your returns online you can call the Louisiana Department of Revenue at 1-855-307-3893.

In fact you may have to file all of the following. Who is required to file an estate transfer tax return. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

Louisiana Department of Revenue Taxpayer Services Division P. IRS Form 1041 US. Fiduciary Income Tax Who Must File.

Where is it as it was suppose to be direct deposit. Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day. Direct Deposit is available for Louisiana.

New Orleans also had its own inheritance tax for a short period in the late 1980s for a brief period. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case when an estate transfer tax is due or when the value of the deceaseds net estate is 6000000 or more.

I cant seem to figure out how to answer line 9 of La Form IT-540 Federal Income Tax. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or more. The website for where is my refund states that my return was processed on January 27 2020.

It is levied on only the very largest estatesthose valued at more than 1206 million for deaths in 2022. 13 rows Estate Transfer Tax RS. Preparation of a state tax return for Louisiana is available for 2995.

E-File is available for Louisiana. When I try to work with the form itself instead of the questionnaire I cant fill in the line manually. Original return Amended return Partial return Date of originalaaa Real estate Louisiana property only Stocks and bonds Mortgages notes and cash Insurance Other miscellaneous property.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. The terminology is confusing but the federal giftestate tax is a wholly different tax. I was a partial resident in Louisiana for 3 months and have filed my taxes in January 2020.

However tax time is a good opportunity to review withholding and deductions to avoid a surprise tax bill when filing 2022 returns next year. The decedent and their estate are separate taxable entities. This article discusses income tax on an estatenot estate tax.

I cant find any question about it in the questionnaire. A nonresident who received gambling winnings from Louisiana sources and who is required to file a federal income tax return must file a Louisiana return reporting the Louisiana income earned. E-Filing non-resident LA state returns is not available.

If the amount withheld is overpaid a refund of the difference will be issued or credited to the tax liability for the following year based upon the. This is April 07 2020.

Pin By Jessica Caperton On Paparazzi Home Business Paparazzi Jewelry Paparazzi Join Paparazzi

First House Then Marriage Iggy Azalea And Nick Young Buy Selena Gomez S Estate Selena Gomez House Starter Home Celebrity Houses

Louisiana Inheritance Laws What You Should Know Smartasset

Louisiana Tax Deadline Extension And Relief For Winter Storm Victims Tax Deadline Winter Storm Storm

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Inheritance Tax Estate Tax And Gift Tax

Singing Every Step You Take Every Request You Make I Ll Be Guiding You In Realestate That Is I Ta Real Estate Advice New Orleans Jefferson Parish

Louisiana Estate Tax Everything You Need To Know Smartasset

Soaring Home Values Mean Higher Property Taxes

Imperial Community To Embrace Sugar Land S History Imperial Houston Real Estate Company Town

Brandon Belt San Francisco Giants First Baseman Recently Sold His Alamo California Home For 3 5 Mi Home Improvement Loans Craftsman Style Porch Small House

Thaikitchenla Is More Than A Thai Food Restaurant Their Expansive Menu Covers Everything From Sushi And Sashimi Cajun Cuisine Vegetarian Dishes Creole Gumbo

W10 Form J10 Visa Five Reasons Why W100 Form J10 Visa Is Common In Usa W2 Forms Tax Forms Filing Taxes

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Meta Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates

Controversial Article Gentrification And Its Discontents Notes From New Orleans By Richard Campanella New Orleans Historical Geography New Orleans Louisiana

Stocktwits University Stocktwitsu Stocktwits Finance Bubbles Finances Money